Market Analysis

Bitcoin ETF Inflows Set Records—But History Suggests Caution

back_to_articles

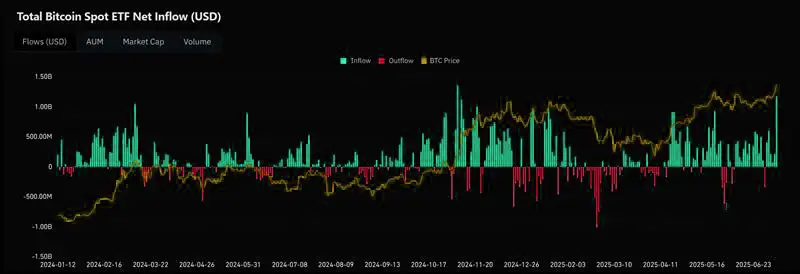

Today we are presenting a very gentle tip for crypto enthusiasts: As Bitcoin surges to fresh highs, investors are pouring unprecedented capital into spot Bitcoin ETFs. According to recent data (see the chart below), this surge in inflows has historically been followed by periods of profit-taking and market corrections.

While this isn’t a guaranteed outcome, understanding these cyclical patterns can help you navigate volatility more confidently.

Key Observations from Historical ETF Flows:

Sharp Inflows Often Precede Outflows:

- Major inflow spikes have frequently been followed by significant outflows as investors lock in gains.

- Example: Similar inflow surges in early 2024 were followed by rapid outflows and price retracements.

Momentum Can Shift Quickly:

- Inflow euphoria can drive Bitcoin to new highs, but the underlying liquidity can reverse in a matter of days.

- Outflows often coincide with short-term corrections or consolidations.

No Rule of Thumb, but a Valuable Signal:

- This pattern is not an ironclad rule, but rather a historical tendency worth watching.

- Awareness of these flows can help you avoid emotional decision-making during extreme moves.

If we want to follow classical technical analysis, price has still additional room to the upside, hence we can conclude that profit taking for long can be done soon enough, while it is still a bit early to jump for sells, specially if there is yet, no clear sign of bears / bearish momentum kicking in.

What This Means for You:

While the current market momentum is undeniably strong, it’s worth taking a moment to consider how ETF inflows could foreshadow a near-term shakeout.

Use this insight as a cool tip, not a definitive prediction:

Stay agile.

Stay informed. And plan for both sides of the trade.