Market Analysis

Fed Under Pressure, CPI in Focus: Markets at the Intersection of Politics and Inflation

Jan 13, 2026

back_to_articles

Executive Summary

Markets are navigating a rare convergence of political risk and macro data. A criminal investigation into Jerome Powell has raised questions about Federal Reserve independence, while December Consumer Price Index data is expected to confirm that inflation remains sticky above target. Together, these forces shape near-term expectations for rates, the US dollar, and global risk assets.

1. The Powell Investigation: Why It Matters

Federal prosecutors have opened an investigation into whether Chair Powell misled Congress regarding cost overruns tied to the Fed’s Washington headquarters renovation. The probe approved by a Trump-aligned U.S. attorney comes against a backdrop of repeated political pressure on the Fed to cut rates more aggressively.

Powell has characterized the move as “unprecedented,” warning it risks undermining the Fed’s independence. Lawmakers from both parties have pushed back, with some Republicans signaling they may block future Fed nominations until the matter is resolved. Markets initially priced a “Fed-independence risk premium,” pressuring the dollar, but subsequent political resistance has helped stabilize sentiment.

Market takeaway: If the investigation fades without escalation, markets may paradoxically read it as strengthening Powell’s mandate reducing political interference risk and supporting a more data-driven, potentially hawkish Fed stance.

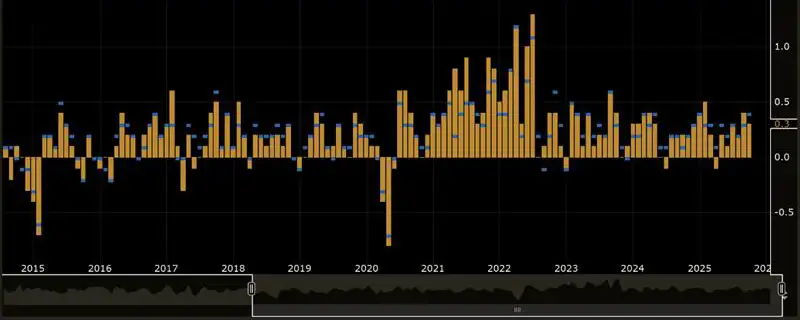

2. CPI Preview: Sticky, Not Surging

Consensus expects December headline CPI at 2.7% YoY and 0.3% MoM, with core CPI also near 2.7% YoY. Several banks warn of upside risks to the monthly core print (as high as 0.4% MoM) due to distortions from the earlier government shutdown and altered data collection timing.

While inflation has eased from prior peaks, it remains well above the Fed’s 2% target. Policymakers have emphasized that inflation is no longer the most acute risk but it is not yet conquered.

3. Rates, FX, and Asset-Class Implications

- Rates: Markets currently price high odds of no change at the January FOMC, with total easing this year still expected but back-loaded. CPI would need to surprise materially to alter this path.

- USD: As Fed-independence fears subside and CPI risks skew slightly higher, the dollar has room for tactical recovery, though upside may be capped after recent repricing.

- EUR/USD: With widening US-EU front-end rate differentials and limited euro catalysts, downside risks dominate unless US inflation meaningfully undershoots.

- Gold & Risk Assets: Political pressure on the Fed supports gold structurally, but near-term price action hinges on CPI and real-rate expectations rather than headlines alone.

CPI Response Expectations:

CPI hotter than expected (core ≥ 0.4% MoM): Front-end yields rise and rate cuts get pushed out, supporting a broader USD bid. EUR/USD drifts lower toward 1.16–1.155 while USD/JPY pushes toward 159–160. Equities turn risk-off with tech underperforming, gold faces short-term pressure from higher real yields, and crypto softens as liquidity tightens.

CPI in line (core ≈ 0.3% MoM): Rates remain stable and post-release volatility fades, leaving the USD consolidating rather than extending. FX stays range-bound with EUR/USD holding 1.16–1.17, equities stabilize or grind higher, and gold and crypto trade sideways driven more by sentiment than macro.

CPI softer than expected (core ≤ 0.2% MoM): Yields fall and rate-cut expectations move forward, weighing on the USD. EUR/USD rebounds toward 1.175–1.18 while USD/JPY drops sharply. Equities flip risk-on led by growth, gold strengthens on lower real yields, and crypto rallies on improved liquidity conditions.

Overlay: Any renewed escalation around the Powell investigation would cap USD upside and support gold regardless of the CPI outcome.

4. The Bigger Picture

This episode underscores a core tension for 2026: political pressure versus institutional credibility. Inflation is cooling only gradually, the labor market is softening but not breaking, and the Fed remains constrained by both data and optics. For now, markets appear willing to refocus on fundamentals provided the investigation does not escalate into a direct challenge to monetary policy autonomy.

Bottom Line

- CPI is the immediate catalyst; Fed independence is the latent risk.

- A contained investigation plus firm inflation data favors rates on hold and USD stabilization.

- Escalation on the political front would reprice risk quickly, reviving volatility across FX, gold, and equities.