Market Analysis

Markets Enter 2026: Geopolitics Loud, Fundamentals in Control

Jan 6, 2026

back_to_articles

1. Global Overview

Global markets have entered 2026 facing a rare combination of geopolitical shock, late-cycle macro uncertainty, and stretched asset valuations. The U.S. military intervention in Venezuela and the capture of Nicolás Maduro has introduced headline risk across energy, FX, and risk assets, while investors simultaneously digest a pivotal U.S. labor market report that could determine the Federal Reserve’s next policy move. Despite the noise, initial market reactions remain relatively contained suggesting that positioning, liquidity, and expectations are playing a larger role than headlines alone.

2. Geopolitical Shock: Venezuela and U.S. Intervention

The U.S. decision under Donald Trump to remove Maduro marks the most direct U.S. intervention in Latin America since Panama in 1989. Markets are weighing two opposing narratives:

- Short-term risk: heightened geopolitical uncertainty, disrupted Caribbean air traffic, legal ambiguity around sovereignty, and potential congressional pushback on funding.

- Long-term optionality: the theoretical unlocking of Venezuela’s vast oil reserves “the largest proven reserves globally” which could reshape medium-term energy supply dynamics.

However, reality tempers optimism. Venezuela currently produces <1 million barrels/day, under 1% of global supply, with infrastructure degraded after decades of underinvestment and nationalization. Even under a stable transition, years of capital, security, and political clarity would be required before production meaningfully rises.

Market verdict so far: geopolitical risk premium is muted; credibility of rapid supply expansion is low.

3. Energy Markets: Why Oil Isn’t Spiking

Crude prices fell modestly following the intervention—counterintuitive at first glance, but rational on closer inspection.

- Brent Crude trades near $60–61/bbl

- WTI Crude hovers around $57/bbl

Key reasons:

1. Venezuela’s current output is too small to create immediate supply shocks.

2. Markets discount execution risk, not reserve size.

3. Global growth expectations remain fragile, limiting upside demand pressure.

4. Oversupply fears resurface if long-term Venezuelan output ever normalizes.

1. Venezuela’s current output is too small to create immediate supply shocks.

2. Markets discount execution risk, not reserve size.

3. Global growth expectations remain fragile, limiting upside demand pressure.

4. Oversupply fears resurface if long-term Venezuelan output ever normalizes.

Strategic takeaway: oil markets are treating Venezuela as a long-dated option, not a near-term catalyst.

4. Equities: Resilient, but Selective

U.S. equity futures opened the year steady to higher:

- S&P 500: marginal gains

- Nasdaq 100: outperforming on AI momentum

- Dow Jones Industrial Average: stable but lagging growth sectors

Markets appear conditioned to absorb geopolitical headlines unless they directly alter earnings, liquidity, or monetary policy. Investors continue to favor:

- AI infrastructure & data centers

- Quality balance sheets

- Pricing power amid slower growth

Hidden risk: complacency. Repeated geopolitical shocks increase tail risk, even if spot volatility stays contained.

5. Safe Havens: Gold Reasserts Its Role

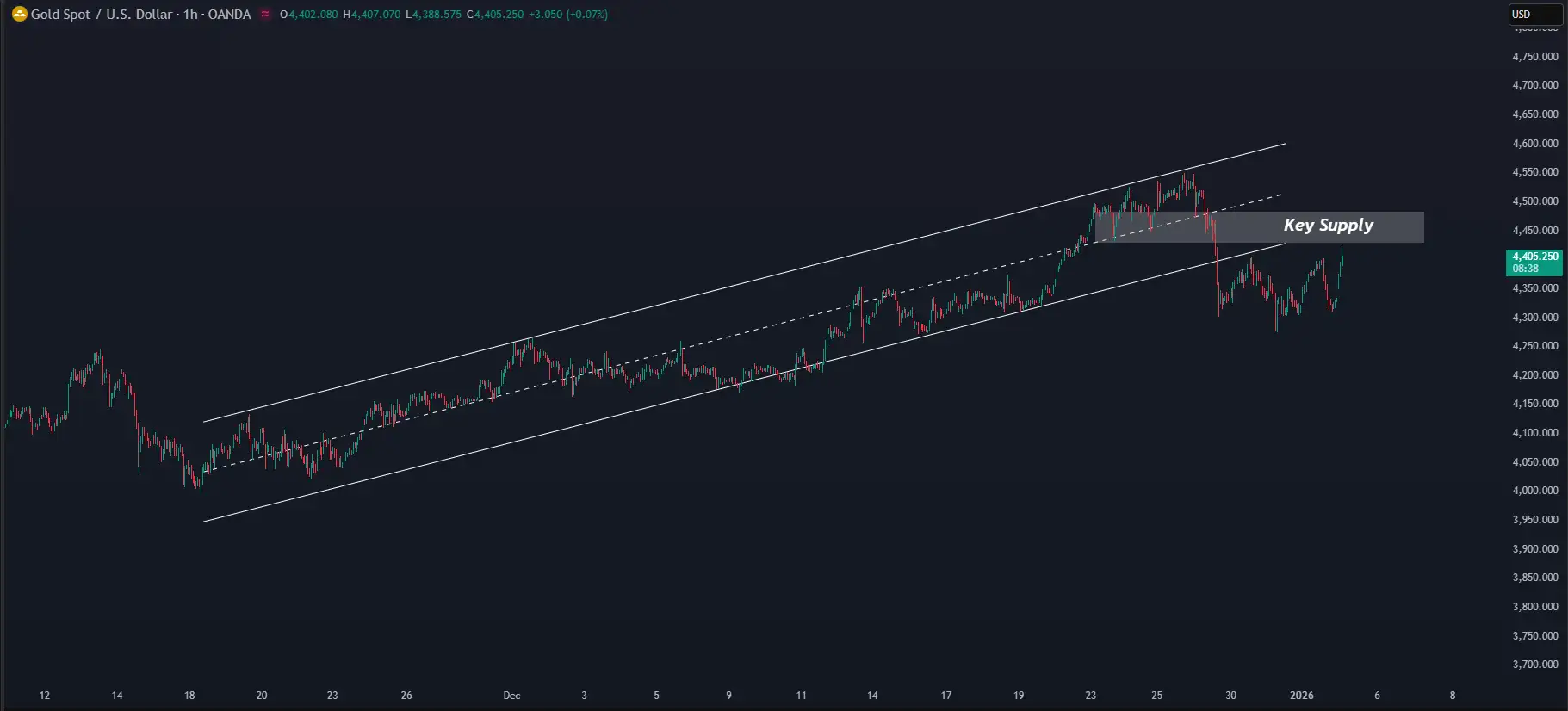

Gold has re-emerged as a geopolitical hedge:

- Gold trades near $4,400/oz, after one of its strongest years in decades.

Drivers:

- Persistent geopolitical instability

- Questions around U.S. global leadership norms

- Gradual erosion of absolute dollar dominance

- Anticipation of eventual Fed easing

Here’s a quick snapshot of Gold’s technical breakdown:

6. FX & Rates: Dollar Strength Meets Policy Uncertainty

The U.S. dollar remains firm, supported by relative growth and yield differentials, but cracks are emerging:

- Markets are increasingly sensitive to U.S. labor data

- December jobs report (expected ~54k) is pivotal

- Weak data strengthens the case for rate cuts

- Strong data delays easing and supports USD carry trades

Federal Reserve officials remain divided, emphasizing data dependence amid late-cycle signals.

7. Macro Calendar:

This is not a quiet start to the year. Key catalysts include:

- ISM Manufacturing & Services PMIs

- ADP Employment

- Weekly Jobless Claims

- U.S. Nonfarm Payrolls (Friday)

- Early Q4/Q3 delayed data from shutdown effects

- Earnings insight from AI-linked and consumer staples firms

Markets are transitioning from narrative-driven trading back to data-driven pricing.

8. Forward-Looking Scenarios

Base Case:

- Choppy but constructive equities

- Range-bound oil

- Firm gold

- Gradual shift toward rate cuts in H1 2026

Bull Case:

- Clear Venezuela transition roadmap

- Soft labor data → Fed easing

- AI earnings surprise to upside

Bear Case:

- Escalation in Venezuela or elsewhere

- Congressional funding conflict

- Labor market deterioration triggering risk-off repricing

9. Bottom Line

Markets are entering 2026 with confidence, but not conviction. Venezuela has added a new geopolitical layer, yet fundamentals: rates, growth, earnings, remain the dominant pricing forces. Investors are navigating a world where headline risk is frequent, but capital moves only when macro reality changes.

The early weeks of 2026 will test whether this balance holds or whether geopolitics finally forces a broader repricing across assets.