Market Analysis

Market Outlook: A Shifting Landscape of Rotation, Macro Crosswinds, and Tech Repricing

Dec 15, 2025

back_to_articles

Markets head into the new week facing a rare combination of macro uncertainty, index divergence, and sector-specific structural risks that are reshaping positioning across global portfolios. The backdrop is defined by a stabilizing economy, a Federal Reserve that has begun easing policy, and growing skepticism about whether the artificial intelligence boom can sustain its previous pace.

Below is a breakdown of what investors should expect in the coming days.

1. Macro Backdrop: A Crucial Week for Data and Policy Signals

After months of limited visibility due to the U.S. government shutdown, markets will finally receive a heavy wave of delayed economic data:

Key releases this week:

- U.S. Jobs Report (Tuesday) – Crucial for validating the Fed’s concern about labor market softening.

- Retail Sales & Business Inventories – Insights into Q4 consumer momentum.

- CPI Inflation (Thursday) – The most important print of the week; will shape expectations for 2026 rate cuts.

- Existing Home Sales & Consumer Sentiment (Friday) – Final signals on household health.

Alongside data, speeches from Fed officials Stephen Miran and Christopher Waller, both influential and closely tied to the new administration, will provide hints about how far policymakers are willing to ease.

Macro takeaway:

The Fed’s rate cut last week eased financial conditions, but dissent among members (e.g., Goolsbee) highlights uncertainty over future cuts. This tension is already fueling market divergence and volatility.

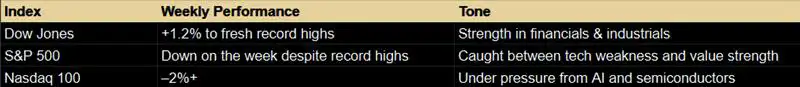

2. Index Divergence Reaches Extreme Levels

Markets are experiencing one of the sharpest splits in years:

Why the Divergence?

1. Rotation From Tech → Value

- Financials (JPM, GS, Visa) and industrials (GE Aerospace) surged.

- Lower rates and improving economic outlook favor cyclical and dividend stocks.

2. Tech Under Pressure

- Broadcom’s earnings sparked a deeper selloff: despite beating estimates, forward guidance raised doubts about the sustainability of the AI boom.

- High-valuation names (Nvidia, AMD, Oracle, Palantir) sold off as traders reassess whether 2024–2025 gains priced too much future growth.

3. The Fed’s Rate Cut

- Supports value stocks (benefit from cheaper borrowing).

- Weakens the USD, contributing to gold strength.

- Adds uncertainty if labor market cooling accelerates.

Interpretation

The rally in the Dow is not just noise, it reflects a structural rotation driven by macro conditions, earnings revisions, and risk appetite.

3. Nvidia/China Dynamics: A New Structural Risk for Tech

A major development came from geopolitical tech tensions:

China Rejecting Nvidia’s H200 Chips

Despite the U.S. allowing Nvidia’s H200 chip exports to China:

- Chinese buyers are rejecting them.

- Beijing is pushing for semiconductor independence.

- Domestic champions like Huawei and Cambricon are being favored.

- Local approval processes may limit imports regardless of U.S. license expansion.

Nvidia’s China revenue from H200 could have been ~$10 billion annually — now at risk.

Why This Matters for the Market

1. AI growth assumptions weaken

- Markets were pricing in China as a guaranteed multi-year demand engine.

- Nvidia’s pricing power and volume expectations may need to be revised down.

2. Geopolitics now affects earnings

- Export controls remain fluid.

- China is committing up to $70 billion in chipmaking incentives, accelerating domestic competition.

3. Sentiment ripple effect

- Broadcom’s selloff was amplified by fears that AI hardware demand could stall globally not just in China.

- The Nvidia China issue adds an additional layer of uncertainty.

Bottom Line

Tech's valuation premium is being challenged on several fronts:

- Guidance risks

- High expectations

- Geopolitical headwinds

- Sector rotation

Together, these pressures justify the heavy divergence between the Dow and the Nasdaq.

4. Gold Strengthens as Defensive Positioning Builds

Gold continues its ascent:

- Dollar weakness after the Fed cut

- Sticky inflation (3.1% in November)

- Central bank buying (280 tonnes in Q3 2025)

- Rising global geopolitical tensions

- Manufacturing slowdown in Europe and China

This is consistent with investors reallocating away from risk.

5. What to Expect This Week

1. Increased Volatility Around CPI and Jobs Data

Inflation and employment will determine if rate cut expectations for 2026 stay intact.

2. Continued Sector Rotation

If financials and industrials remain strong while tech earnings disappoint, the divergence will widen further.

3. Monitoring AI and Semiconductor Sentiment

Nvidia, Micron’s earnings, and updates from China will be critical to reassessing the AI trade.

4. Watching Dollar Weakness and Gold Strength

A dovish Fed and geopolitical tensions make gold a favorite hedge into year-end.

Final Outlook

The market is currently defined by three major themes:

1. Macro uncertainty around inflation, labor, and Fed communication.

2. Index divergence, with the Dow hitting records while the Nasdaq faces structural repricing.

3. A pivotal shift in tech fundamentals, amplified by U.S.–China chip tensions and broad concerns about the sustainability of the AI boom.

As investors move through the final weeks of 2025, positioning is likely to remain defensive, selective, and sensitive to both data surprises and geopolitical developments. The environment favors value, financials, industrials, and commodities, while growth and AI-heavy tech face heightened volatility and repricing risk.