Market Analysis

Markets Extend Gains as Shutdown Resolution Nears and Earnings Momentum Lifts Sentiment

Nov 4, 2025

back_to_articles

Global markets continued their risk-on momentum this week, buoyed by growing optimism that the U.S. government shutdown, the longest in history is approaching a resolution. The Senate’s advancement of a bipartisan deal and President Trump’s public endorsement have strengthened market conviction that a reopening is imminent, easing one of the most significant policy overhangs of recent months.

The S&P 500 surged past the 6,800 mark, posting a 1.5% gain, while the Nasdaq 100 outperformed with a 2.2% rise, driven largely by a rebound in megacap technology stocks. The Dow Jones Industrial Average climbed 0.8%. The Bloomberg Magnificent 7 Index rallied 2.8%, signaling renewed investor confidence in AI-linked equities after last week’s correction.

As the likelihood of a shutdown resolution grows, bond yields edged higher, with 2-year Treasuries up three basis points to 3.59%, and 10-year yields rising to 4.11%, reflecting improved economic optimism. The dollar underperformed against most peers, while gold surged 2.8% to $4,112 per ounce, underscoring continued hedging demand amid shifting monetary expectations.

Policy Outlook: Fed Eyes December Cut Amid Data Delays

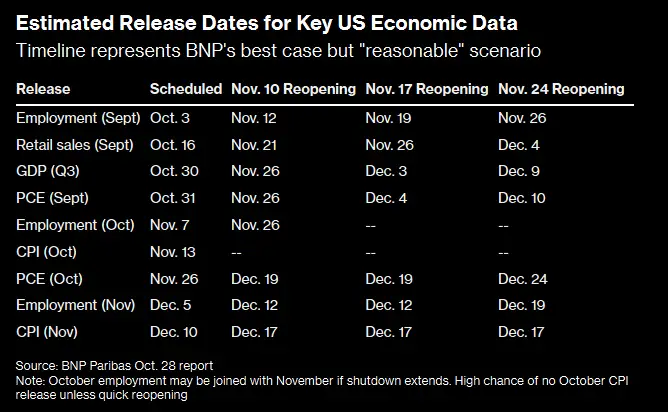

The reopening of the U.S. government would restore the flow of delayed economic data vital for the Federal Reserve’s policy decisions. Analysts expect the September employment report to be released within days of the shutdown’s end, followed by inflation and spending figures in subsequent weeks.

According to Evercore ISI’s Krishna Guha, access to updated labor data could “refresh and sustain the picture of a soft labor market,” increasing the probability of a December rate cut. Market-implied probabilities show roughly a 60% chance of a 25 bps cut, a shift from the full pricing observed in mid-October.

While Fed Chair Jerome Powell has maintained a cautious tone, suggesting a cut is not guaranteed, doves like Stephen Miran and Mary Daly have cited weakening demand and easing inflation pressures as arguments for additional accommodation.

UBS’s Ulrike Hoffmann-Burchardi noted that “an end to the government shutdown removes a major macro uncertainty and allows the Fed to re-anchor its policy outlook with real data rather than estimates.”

Earnings Season Reinforces Equity Optimism

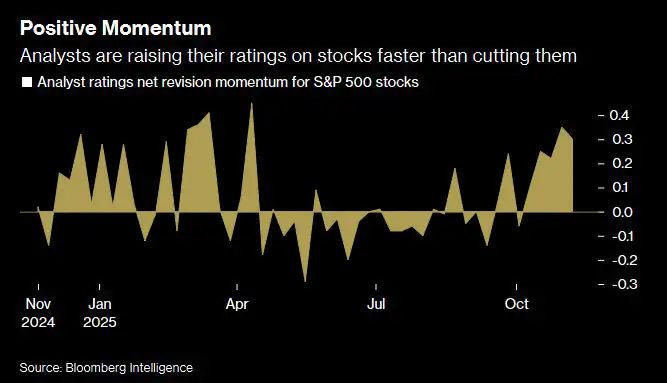

Corporate fundamentals remain a key support for risk assets. Companies in the S&P 500 reporting so far have posted 14.6% year-over-year earnings growth, nearly double analyst forecasts.

Matched with this beat in earnings, positive momentum is building across markets as well, as analysts increasingly lift their ratings and price targets to the upside.

Big Banks emphasized that “the combination of Fed easing and robust corporate earnings remains favorable for equities, particularly in transformational growth themes such as AI and automation.”

Sector and Corporate Highlights

- Verizon Communications raised $11 billion in investment-grade debt to fund its Frontier acquisition, extending the trend of large-cap firms locking in low-cost funding.

- Visa and Mastercard reached a long-awaited agreement to lower certain merchant fees, reducing pressure from retailers and regulators.

- Coinbase announced a new platform granting select investors early access to upcoming tokens, signaling continued innovation in digital asset infrastructure.

- Barrick Mining and other gold producers rallied as spot gold broke above $4,100, supported by geopolitical uncertainty and strong demand for inflation hedges.

- Roche Holding reported successful late-stage trials for a new multiple sclerosis treatment, boosting sentiment in European healthcare equities.

- Restaurant Brands International advanced after announcing the sale of a majority stake in its China unit, aligning with a broader push by Western firms to localize operations in Asia.

Macro Themes to Watch

1. Data Normalization Timeline: Analysts estimate it will take several weeks after reopening for complete economic data restoration, with quality concerns possibly extending into early 2026 (BMO Capital Markets).

2. Rate Cut Probability: Markets continue to price a December cut amid mixed Fed communication, highlighting potential policy divergence if inflation stabilizes.

3. Earnings Momentum: Strong Q3 performance and robust revisions suggest a favorable backdrop for equities into 2026.

4. AI & Tech Leadership: Market direction hinges on whether leading AI and semiconductor names can sustain momentum following recent volatility.

5. Shutdown Aftermath: Beyond sentiment, the reopening will likely trigger reacceleration in federal spending and economic reporting, restoring clarity for both policymakers and investors.

2. Rate Cut Probability: Markets continue to price a December cut amid mixed Fed communication, highlighting potential policy divergence if inflation stabilizes.

3. Earnings Momentum: Strong Q3 performance and robust revisions suggest a favorable backdrop for equities into 2026.

4. AI & Tech Leadership: Market direction hinges on whether leading AI and semiconductor names can sustain momentum following recent volatility.

5. Shutdown Aftermath: Beyond sentiment, the reopening will likely trigger reacceleration in federal spending and economic reporting, restoring clarity for both policymakers and investors.

Final View:

The near-term market outlook remains constructive as policy clarity improves and corporate earnings maintain momentum. We expect volatility to moderate in the coming sessions as traders recalibrate around the evolving macro landscape.

However, with uncertainty surrounding delayed inflation data and the Fed’s December decision, tactical flexibility remains essential.

However, with uncertainty surrounding delayed inflation data and the Fed’s December decision, tactical flexibility remains essential.