Market Analysis

Global Market Brief : “Liquidity Tightens as Wall Street Opens a Pivotal Month”

Nov 5, 2025

back_to_articles

Global markets began November on a cautious yet constructive tone. U.S. equity futures edged higher after a strong October driven by the artificial-intelligence theme, but tightening global liquidity, ongoing government shutdown risks, and renewed softness in crypto markets underline the fragility beneath the surface. Meanwhile, Berkshire Hathaway’s record cash pile, OPEC+’s output freeze, and China’s easing of rare-earth restrictions all reflect a market recalibrating around slower growth and selective risk appetite.

1. Equities: Momentum Meets Caution

- October Recap: All three major U.S. indexes finished October higher S&P 500 (+2.3%), Dow (+2.5%), Nasdaq (+4.7%) helped by AI-driven enthusiasm and improving U.S.China trade sentiment.

- November Kickoff: Historically the strongest month for the S&P 500 (+1.8% average), November opened with futures in positive territory as investors await over 100 major corporate earnings and potential clarity on Trump-era tariffs at the Supreme Court.

- Macro Overhangs: The partial U.S. government shutdown has entered its fifth week, delaying key releases such as the Non-Farm Payrolls (NFP) report and raising uncertainty over fiscal visibility.

2. Macro & Policy Developments

- OPEC+ Pauses Output Increases: The coalition halted planned production hikes for Q1 2026, citing weaker demand and rising inventories. The move underscores a shift from price defense to stability management.

- China-U.S. Trade Thaw: Beijing suspended new rare-earth export curbs and investigations into American chipmakers, easing immediate supply-chain concerns and providing a modest tailwind to semiconductor names.

3. Liquidity Conditions Tighten Globally

Despite easing inflation, central banks remain committed to a higher-for-longer stance, maintaining restrictive liquidity.

Money-market balances and global central-bank balance-sheet data show a continued contraction in excess reserves.

This tightening drains speculative momentum across high-beta assets, from small-cap equities to crypto, and encourages renewed flows into short-duration bonds and cash-equivalents.

Money-market balances and global central-bank balance-sheet data show a continued contraction in excess reserves.

This tightening drains speculative momentum across high-beta assets, from small-cap equities to crypto, and encourages renewed flows into short-duration bonds and cash-equivalents.

4. Crypto Market: Structural Weakness Emerging

Digital assets have started November under pressure, reflecting the broader liquidity withdrawal narrative:

- Bitcoin (BTC) trades near $107 k, failing to reclaim prior breakout zones; the $105 k – $110 k corridor is critical short-term support.

- Ethereum (ETH) hovers around $3.6 k – $3.7 k; a sustained loss below $3.5 k – $3.8 k could accelerate altcoin drawdowns.

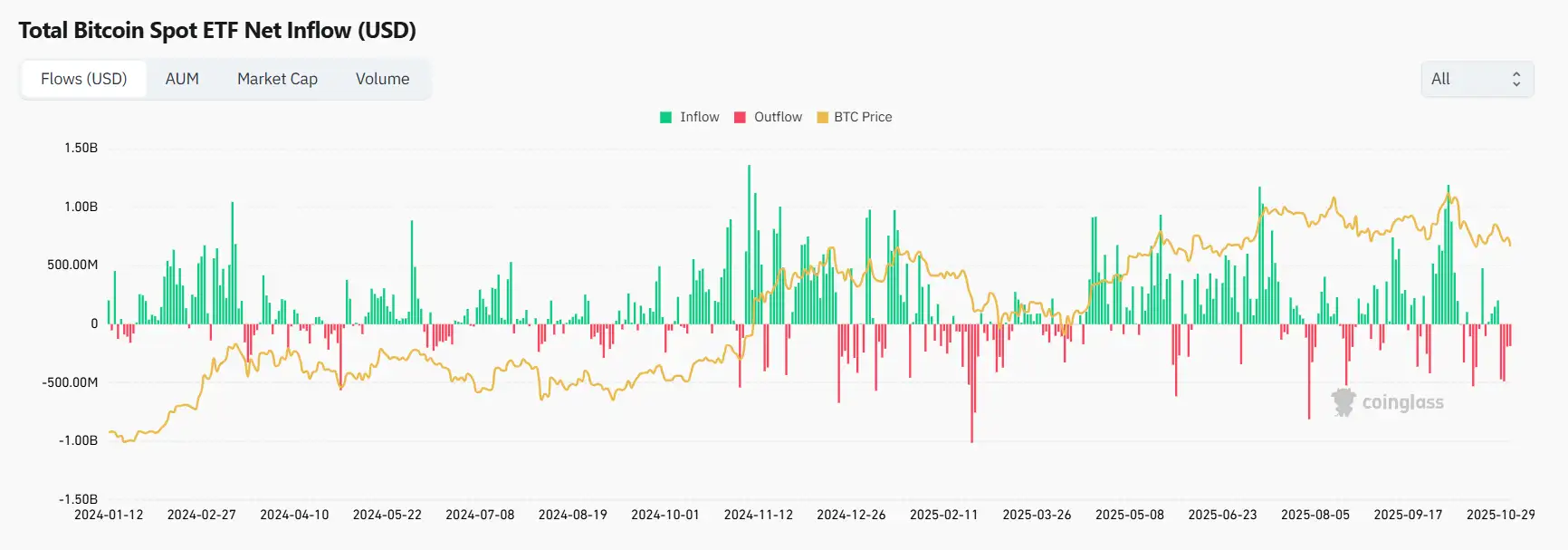

- Institutional flows show renewed net outflows from ETFs and custodial products, suggesting profit-taking and rotation into defensive assets.

- Technical structure: BTC’s lower-high rejection pattern on higher timeframes points to a maturing up-cycle rather than the start of a new leg higher.

Overall, the crypto complex is confronting a liquidity-tight environment and reduced risk tolerance conditions that historically precede deeper consolidations.

5. Outlook: Selectivity Over Speculation

- Short-term: Investors should expect range-bound volatility until key macro catalysts the delayed NFP report, Supreme Court tariff ruling, and Fed communication restore visibility.

- Medium-term: While AI-driven growth stories continue to underpin market optimism, the record cash levels at corporate and household levels hint at latent caution rather than full-risk engagement.

- Crypto & Liquidity: Unless global liquidity expands again, crypto markets may remain the most vulnerable pocket of risk assets, mirroring conditions seen in early 2022.

Key Takeaways

- Equity momentum persists, but valuations are stretching against a backdrop of higher real rates.

- Corporate caution rises, exemplified by Berkshire’s record cash.

- OPEC+ pause and China trade easing stabilize commodities but do not erase oversupply risks.

- Liquidity tightening and institutional outflows weigh heavily on speculative assets, notably crypto.

- Investor positioning: Favor quality balance sheets, short-duration income, and selective exposure to AI and defensive growth themes.