Market Analysis

FOMC Minutes, Nvidia Earnings, and Gold: One Narrative, Three Stress Tests

Nov 19, 2025

back_to_articles

Over the next 48 hours, markets face a concentrated risk cluster:

- FOMC minutes,

- Nvidia’s Q3 earnings, and

- Gold trading near record-adjusted levels.

All three revolve around one core question:

Can the market sustain a lower-rates, AI-driven growth narrative without breaking on valuations or policy credibility?

1. FOMC Minutes – What the Market Is Really Looking For

Policy setup

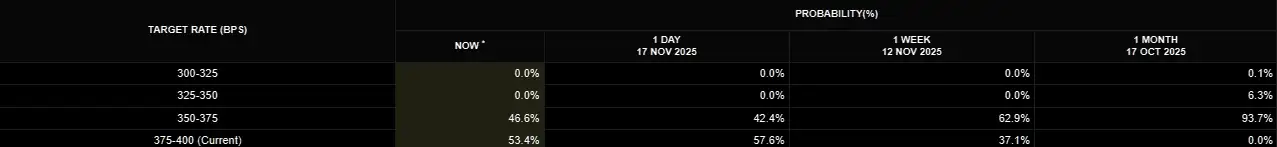

- The Fed cut rates by 25 bps in October, taking the target range to 3.75–4.00%, and markets are now almost perfectly split on whether we get another cut in December. Fed funds futures are pricing roughly a 40–50% probability of an additional 25 bps reduction at the Dec 9–10 meeting.

- The complication: the longest US government shutdown on record delayed key data releases, notably the September jobs report. That’s forced policymakers to rely on partial indicators (claims, PMIs, private surveys) rather than the full macro picture.

What markets want from the minutes

The October FOMC minutes (Oct 28–29 meeting) are important not because of the base case (one more cut is already well-telegraphed) but because of the distribution of views inside the Committee:

1. How uncomfortable are they with further easing without fresh data?

- Any language that sounds like “we’ve done enough for now” will push the market closer to a single-cut cycle narrative.

2. How do they frame the labor market?

- Delayed September NFP (expected ~+50k, unemployment at 4.3%) is only now coming out, and jobless claims have drifted higher.

- If the minutes downplay labor softness, that’s hawkish relative to current pricing.

3. Balance sheet and liquidity

- Markets will read any hint about reserve management purchases as a stealth shift toward more accommodation later in 2026, which is supportive for duration and gold.

Bottom line on the minutes:

- A “cautious doves” tone (division on further cuts, stress on data dependence) would support the USD and front-end yields, add pressure to high-beta tech, and cap gold in the very short term.

- A “growth worries + labor cooling” tone would re-anchor the December cut, steepen the curve at the margin, and be supportive for gold and long-duration AI names, including Nvidia, if earnings cooperate.

2. Current Market Impact & Risk Sentiment

Heading into the event cluster, price action already looks like a market that’s long risk and short conviction:

- Equities:

- S&P 500 and Nasdaq 100 started the week with ~0.9% and ~0.8% losses respectively, their weakest closes in about a month, as a broad risk-off move hit stocks, crypto and even gold simultaneously.

- Rates & USD:

- Treasuries and the US dollar have reclaimed safe-haven status, with the DXY grinding higher as risk assets wobble.

- Macro calendar overhang:

- A “data deluge” is coming: delayed September jobs, existing home sales, durable goods, PMIs and multiple Fed speakers all hit in the same week.

- That means post-minutes there is still plenty of macro event risk that can either confirm or contradict whatever tone we read in the minutes.

3. Nvidia Q3: Earnings as a Macro Event

Nvidia’s earnings this week are not just a micro story; they are effectively a liquidity and sentiment referendum for the entire AI trade.

Street expectations

Across sell-side desks, the consensus is remarkably tight:

- Revenue: ~$54–55 billion for Q3, up ~55–60% YoY

- EPS: about $1.25, with a “normal” beat range up to ~$1.35–1.38 based on recent surprise history.

- Guidance (Jan quarter): around $61–62 billion is widely watched as the line between “strong” and “truly exceptional.”

On top of that, CEO Jensen Huang dropped the now-famous “half a trillion” comment:

- Nvidia has roughly $500 billion of AI chip and networking orders for 2025–2026 combined, spanning the current Blackwell GPUs, next-gen Rubin, and related infrastructure.

- Wolfe Research and others see this as implying meaningful upside vs existing 2026 revenue estimates (data-center sales potentially $60bn above prior forecasts.

- Despite that backlog, NVDA is trading below where it was when Huang made the comment, reflecting valuation fatigue and fears that even blockbuster numbers won’t be “good enough” at current multiples.

Macro read-through

- Upside scenario (clean beat + bullish guide + positive 2026 color):

- Confirms the “AI capex super-cycle” narrative.

- Likely leads to a relief rally in tech, steepens factor rotations back toward growth, and partially offsets any hawkish read from the FOMC minutes.

- Could weaken the USD marginally via improved global risk appetite and put moderate pressure on gold near term.

- Downside scenario (beat but cautious guide, or visible backlog friction):

- Validates concerns that AI valuations ran ahead of fundamentals.

- Triggers de-risking in high-beta tech and AI, widens credit spreads at the margin, strengthens USD + front-end yields.

- In a deeper risk-off extension, gold ultimately benefits once the initial “sell everything” impulse passes.

4. How FOMC + NVDA feed into gold

1. Policy path & real yields

- A dovish interpretation of the minutes (more emphasis on growth risks, tolerance for further cuts) compresses real yields and is structurally bullish for gold.

- A hawkish read could trigger a knee-jerk pullback, but with gold now trading as both a rate hedge and a geopolitical hedge, dips are likely to meet central-bank and real-money demand.

2. Risk appetite channel

- The recent episode where stocks, crypto and gold all fell together is classic forced-deleveraging behavior: leveraged players sell what they can, not what they want.

- Once that deleveraging completes, if NVDA disappoints and broader risk sells off again, gold tends to re-emerge as the “flight to quality” destination, especially if bonds are volatile.

5. Putting It All Together – A Coherent Trade Narrative

You can summarize the whole complex this way:

- FOMC minutes will tell us whether the Fed is leaning toward a single additional cut or a mini easing cycle.

- Nvidia’s earnings will validate or challenge the idea that AI is the new secular growth engine that justifies current equity multiples.

- Gold is the asset that benefits if either of these narratives breaks:

- If the Fed is more dovish than expected → lower real yields, weaker USD, gold up.

- If NVDA or the macro data crack risk sentiment → de-risking, then flight to safety into gold once forced selling is absorbed.