Wall Street Rallies on AI Buzz, but All Eyes Turn to Critical Jobs Report

Feb 24, 2025

Quick Take:

Consensus forecast: ~110k–115k jobs added

Unemployment rate: Expected to tick up to 4.2% from 4.1%

Average Hourly Earnings (AHE): Forecast at 0.2% MoM / 3.7% YoY

FedWatch: 97% chance of no hike tomorrow; 62% chance of a cut in September, both at risk of repricing

Why This Print Matters:

Private hiring is faltering: Just 74k jobs last month, continued softness here signals real labor market cooling

Manufacturing jobs declining: -7k in June, down three straight months

Claims diverge: Initial jobless claims fall (224k), but continuing claims are elevated (1.96M), suggesting slower re-hiring

Wages are the wild card: AHE near 3.5% supports Fed "patience" narrative but any upside surprise could revive hawkish bets

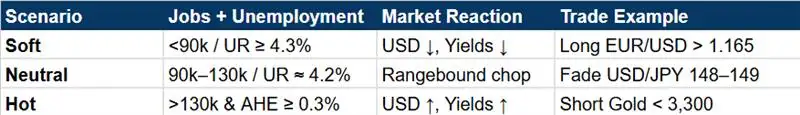

Possible scenarios:

Current Macro Backdrop:

July was volatile: The Dollar Index (DXY) rebounded sharply from 96.40 lows to 100.12, driven by stronger Core PCE data (0.3% MoM vs. 0.2% est.)

AI stocks power equities: Meta +11%, Microsoft +4.4%, Nasdaq eyes a new all-time high

Seasonal NFP trends: August prints average ~160k (ex-COVID years), but recent data points to downside risks

DXY at key inflection: A break above 100.00–100.50 could accelerate USD rebound; failure could lead to renewed selling

Positioning Risks into the Print:

Equities are stretched, near ATHs being vulnerable to any wage upside or hawkish repricing

FX Majors have pulled back from July highs, USD new trend hinges on NFP

Gold and bonds at risk in hot print; yields and rate expectations still highly reactive

Bottom Line:

This NFP is about confirmation or contradiction of a slow-cooling labor market. Private hiring and wage dynamics will be decisive in shaping the Fed’s September decision and the USD’s trajectory into August

Related Articles

Central Banks Diverge: RBA Leans Dovish, Fed Holds Amid Tariff-Driven Uncertainty

Aug 31, 2025

Markets on Edge: OPEC+, Gold Tariffs, and Central Bank Shifts Reshape Global Outlook

Aug 8, 2025

S&P 500 Hits New High as Trade Hopes Rise, Eyes on Tesla & Big Tech Earnings

Jul 23, 2025